The simplest way to start a business in the Philippines.

StartBase is building the software infrastructure for hassle-free company creation in the Philippines, working with vetted tax and legal partners so you can focus on your product while we take care of the rest.

Focus on your business. We'll handle the details.

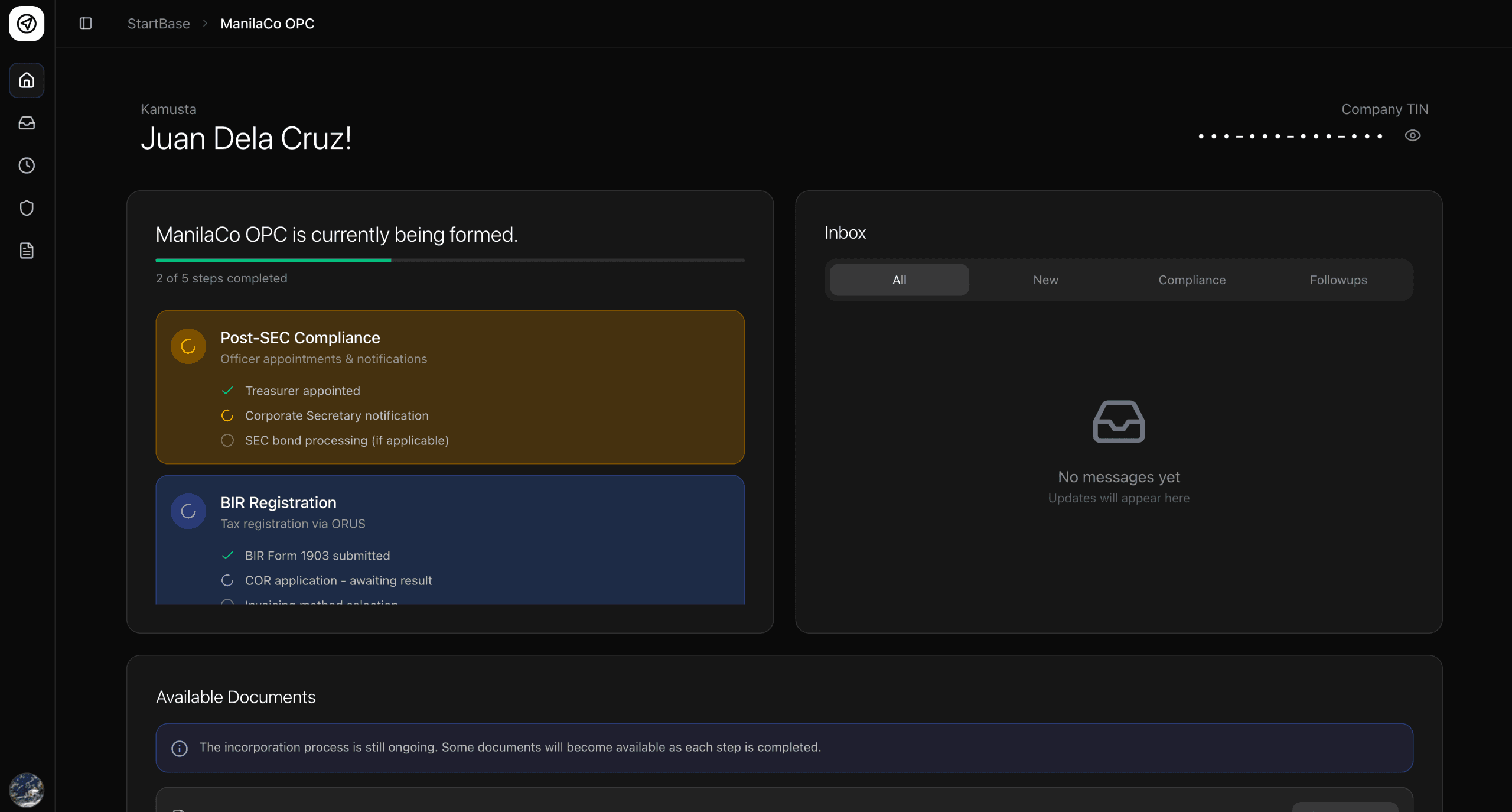

Launching a company shouldn't mean spending weeks decoding SEC, BIR, and LGU requirements. StartBase takes you through each step in one guided flow, with clear timelines and a live dashboard that shows exactly where your registration stands from start to finish.

Why founders choose StartBase

End-to-end handling

We collect your details once, prepare your SEC, BIR, and LGU documents, and coordinate filings with our partner professionals. You are not the one lining up, calling offices, or guessing what comes next.

Built for founders, not accountants

Your dashboard shows what is done, what is in progress, and what we still need from you in plain language. No tax jargon, no form codes to memorize, no government office hopping.

Transparent pricing. No surprises.

You see flat, all-in pricing and clear inclusions before you pay. Government fees and timelines are explained upfront, so you never get hit with 'extra processing' charges halfway through.

PHP 24,999

to go from zero to one.

Save time and focus on your business while we do the rest

SEC Incorporation¹

We prepare and file your SEC incorporation through eSPARC, set up your OPC or corporation correctly, coordinate e-signatures, and handle every follow-up until approval.

BIR Registration¹

We secure your BIR Certificate of Registration (Form 2303), TIN, and registration of books and official receipts. You become legally able to issue ORs and pay taxes.

LGU Permits¹

We handle your Barangay Clearance and Mayor's Permit applications. You end up fully LGU-compliant without losing days to government errands.

Corporate Secretary¹

We provide a qualified Corporate Secretary² to handle your compliance requirements and maintain your corporate records.

Treasurer¹

We provide a qualified Treasurer to manage your corporate financial records and compliance obligations.

Secure Dashboard

Track every step of your incorporation in one clean dashboard: what's done, what's pending, and expected timelines.

Email Support

We send clear updates at every milestone. When you reply with questions, a real person answers with specific next steps.

Tax Reminders

We set up a tax calendar tailored to your business and send reminders before monthly, quarterly, and annual deadlines.

Office Address³

Get a premium business address as your principal office address for SEC and BIR registration. Perfect for home-based or remote businesses.

¹ We partner with vetted legal firms and tax firms to ensure that your documents are prepared and filed correctly.

² First month free for all new incorporations. Terms and conditions apply.

³ We wil provide you with your own premium registered business address with StartBase 365 courtesy of our leasing partners.

If your corporation or OPC cannot be completed and the process has to stop midway, we refund the unused portion of our professional fee.

Your data stays protected.

We follow the Data Privacy Act (RA 10173), collect only what is needed for SEC, BIR, and LGU filings, and store your documents in secure, encrypted systems. Your information is used solely for your registrations and shared only with trusted service providers acting on our behalf, including tax and legal partners and the relevant government agencies, never for unrelated purposes without your consent.

Learn moreSimple as 1 - 2 - 3.

Click "Request Access"

Apply for early access, no commitment required.

Go through the application process

Tell us about you, your business, and proposed name, and we'll request a one-time payment.

We'll reach out to you

We'll verify your identity, prepare your documents and go to you so we can finalize everything.

Sit back and Relax

While we do all the work and you focus on your business.

Use your business

You'll receive all official documents, ready to invoice, open a bank account and operate.

Frequently Asked Questions

We’re starting with one-person corporations so we can deliver a fast, reliable playbook for a single founder. Once that flow is battle-tested, we’ll open multi-founder corporations without compromising speed or accuracy.

Most incorporations finish in about 3–5 weeks, depending on SEC, BIR, and LGU queues. We handle the follow-ups and coordination so you are not the one chasing every office.

No. With a signed Special Power of Attorney (SPA), StartBase can file and process your documents on your behalf while you stay focused on your business.

No. StartBase is a software-powered compliance and operations platform, not a law firm. We prepare and file documents as your authorized representative and, when needed, coordinate with partner professionals. For specific legal advice, we’ll point you to a law firm.

No. Fixers rely on shortcuts, side payments, and undocumented processes that can backfire during audits, bank checks, or due diligence. StartBase uses only official channels, proper authorizations, and traceable payments so your business is clean, defensible, and investor-ready.

We cannot open the account for you because of BSP KYC rules, but we prepare all required documents, help you choose a bank, and coordinate introductions where possible so your onboarding is smoother and faster.

You only pay after your application passes our review and is accepted into early access. We then invoice you a one-time fee under your name before we start the government filings.

During early access, payments are processed under a consulting setup. Official receipts will be issued once StartBase is operating under its own registered entity, and you’ll receive a formal record of your payment either way.

Ready to start your business?

Apply for early access and let StartBase handle the paperwork — so you can focus on building something that lasts.